housing allowance for pastors freddie mac

2 days agoThe Federal Housing Finance Agency FHFA had said that future commitments had to fit within Freddie Macs annual product cap 78 billion for 2022. 10 Housing Allowance For Pastors Tips 1.

Nontaxable Income Can Be Grossed Up For Mortgage Approvals

Although the housing finance industry may understand the basic denial causes discovering how applicants respond after a denial can inspire potential solutions to increase.

. The new user friendly SellerServicer Guide will make it significantly easier for you and your team to find understand and share critical information. The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you cant exclude as wages on line 1 of Form 1040.

Here are two article1 article 2 that explain it for you. Ministers housing expenses are not subject to federal income tax or state tax. Bankruptcy and Other Litigation Involving Freddie Mac-Owned or Guaranteed Mortgages.

This requirement does not apply to military quarters. Your housing allowance is also limited to an amount that represents reasonable pay for your ministerial services. Selection Retention and Management of Law Firms for Freddie Mac Default Legal.

Your home is affordable if you spend 30 percent or less of your income on your monthly rent or mortgage payment plus utilities according to the US. The housing allowance for pastors is not and can never be a retroactive benefit. In 2017 Freddie Mac provided a 137 million in 9 LIHTC forward commitment to River West in Tulsa Oklahoma.

If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month. The amount and duration of. The IRS allows a ministers housing expenses to be.

Only expenses incurred after the allowance is officially designated can qualify for tax. Department of Housing and Urban. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self.

The lender must verify the borrowers income in accordance with Section B331 Employment and Other Sources of Income. The property now provides 222 housing units across a. That means that if you only work ten hours a week at the.

The lender must obtain. But now FHFA said that 3. The housing allowance may be added to income but may not be used to offset the monthly housing payment.

For example if your housing allowance is 12000 per year and you only spend 11000 on housing expenses youll need to include the 1000 in your gross income. The pastors Housing Allowance is confusing to pastors church members and many times to tax preparers too.

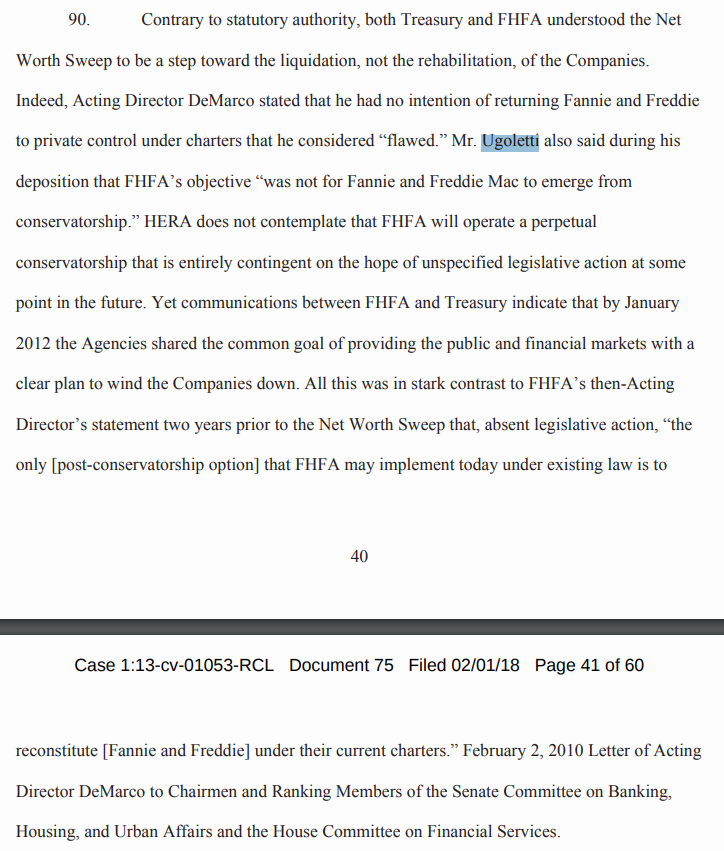

Pastoral Housing Allowance Using Nontaxable Income To Buy A Home

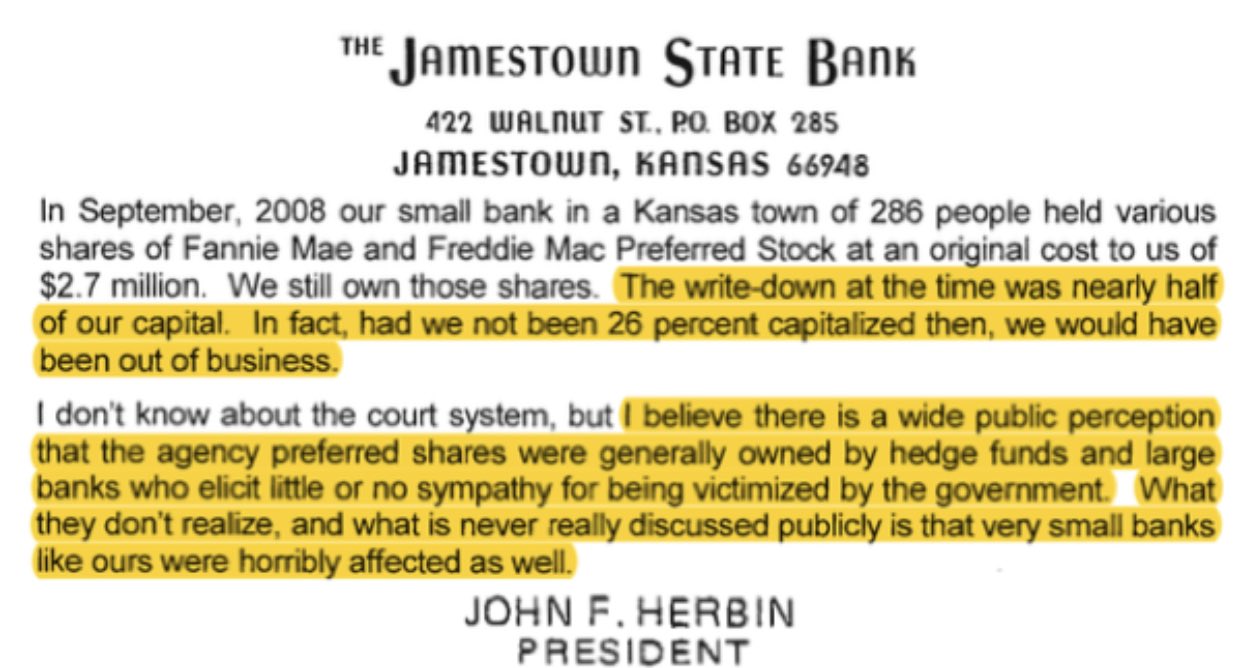

Gse Receivership Avoided Otcmkts Fnma Seeking Alpha

Using Basic Allowance For Housing Bah On Va Loans

National Mortgage Professional Magazine July 2016 By Ambizmedia Issuu

Fannie Mae And Freddie Mac Executive Bonuses C Span Org

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Va Loan A Step By Step Guide

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Four Important Things To Know About Pastor S Housing Allowance Churchstaffing

Mortgage Rates Are Rising Much Faster Than Treasury Yields What S The Deal Wolf Street

What Expenses Qualify For The Minister S Housing Allowance The Pastor S Wallet

10 Housing Allowance Tips For Ministers What Ministers And Churches Need To Know

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Tim Pagliara Timpagliara Twitter

Tim Pagliara Timpagliara Twitter

Economic Scandal Hi Res Stock Photography And Images Alamy

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages 4 Things Every Borrower Needs To Know To Get Approved For A Mortgage Loan In Kentucky

10 Housing Allowance Tips For Ministers What Ministers And Churches Need To Know