florida estate tax limit

There is no inheritance tax or estate tax in Florida. In 2022 you will be taxed if the total of the gross assets at hand exceeds 1206 million.

Florida Property Tax H R Block

That will increase to 8 counties in 2013.

. Under Florida statute where as estate is valued at less than 75000 or the decedent has been dead for more than two years any beneficiary of the estate may file a petition for summary administration of the estate. Upon approval by the court of the petition the court may order the immediate distribution of the assets of the. As mentioned the estate tax is only an issue for people dying with over 1206 million 2021.

Estate income tax returns are only required if estate assets generate more than 600 of income annually. Whether or not probate will be necessary Florida law requires that anyone who has possession. To qualify for this fast-track procedure the decedents estate must not be worth more than 6000 of nonexempt property and not include any real property.

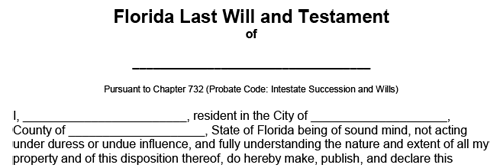

Municipal governments in Florida are also allowed to collect a local-option sales tax that ranges from 0 to 15 across the state with an average local tax of 1037 for a total of 7037 when combined with the state sales tax. The Florida estate tax is tied directly to the state death tax credit provided in IRC. A note about wills.

In 2022 the estate tax threshold for federal estate tax is 11 million and seven hundred thousand dollars 1170000000 meaning that if a decedent has less than 11 million and seven hundred thousand dollars in assets there will be no estate tax. 19802 for resident decedents and in FS. 7031 Koll Center Pkwy Pleasanton CA 94566.

Subtracting the exemption of 117 million creates a taxable estate of 83 million. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The Florida estate tax is computed in FS.

The 2022 Florida Disaster Preparedness Sales Tax. For any assessed value between 50000 and 75000 an additional 25000 is eligible for exemption but this exemption does not apply to school district taxes. The estate tax is tied with the lifetime gift tax exemption so if you want to give more than the annual exemption amount you can pay the tax on the gift or you can use part of your lifetime gift tax.

The Save Our Homes property tax cap is an amendment to the Florida constitution that limits the annual increase in the tax assessment of homestead property to a maximum of 3 of the prior years assessment. Exempt property includes furniture appliances and household items up to a value of 20000. Chapter 198 Florida Statutes.

You pay full taxes on any value between 25000 and 50000. This year the maximum increase on the assessed value of a Homestead property in Florida has been capped at 3 percent. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

Proper estate planning can lower the value of an estate such that no or minimal taxes are owed. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021. Has an estate tax ranging from 12 to 16.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The individual heirs are generally not responsible for the taxes as the duty to collect and pay the estate tax is the responsibility of the executor or successor Trustee. And its purpose is to encourage the preservation of homestead property and to ensure that Floridians will not lose their homes on the tax block because of.

4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. So lets discuss the specifics. But for a high-volume retailer even small tax discrepancies can add up in the typical 3-year sales tax audit.

The maximum local tax rate allowed by Florida law is 15. Florida does not have an estate tax or income tax so the only taxes that can apply to a Florida estate are federal taxes. Additionally counties are able to levy local taxes on top of the state amount and most do55 of the 67 Florida counties added local sales tax to the state tax in 2012.

Because counties have anywhere from a 0 to 2 discretionary sales surtax rate the dollar amounts can be significant to customers on large transactions. The estate tax is a tax on an individuals right to transfer property upon your death. This puts you in the highest bracket meaning your base payment is 345800.

In Florida there are three ways to settle an estate. Then you subtract the 1 million youve already been taxed on to get that 345800 which means the 40 rate applies to the other 73 million. Exempt property is not included in the total when valuing the estate for this procedure.

The current Consumer Price Index CPI change is 7 percent. Potential Tax Concerns for Inheritances. Floridas general state sales tax rate is 6 with the following exceptions.

Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022. However the personal representative of an estate may still need to complete certain forms to remove the automatic Florida estate tax lien.

But once you begin providing gifts worth more than the applicable annual limit to any individual in a year you. For estates of decedents who died on or after January 1 2005 and before January 1 2013 no Florida estate tax is due. A two-week sales tax holiday starts Saturday to help Florida residents prepare for the 2022 hurricane season.

You can lookup Florida city and county sales tax rates here. This means that when someone dies and the value of their estate is calculated any. The highest amount added to the sales tax was 15 by 7 counties in 2012 bringing the total sales tax to 75 in those counties.

Heres an overview of each one from the simplest and least expensive to the most complicated and costly. Assuming you have not added any new construction to your Homestead property your assessed value cannot increase more than 3 percent in 2022. 19803 for nonresident decedents.

In Florida theres no state-level death tax or inheritance tax but there is still a federal estate tax requirement so if an estate is valued at more than 11 million there is a potential federal estate tax bill and then a return would have to be filed Form 706. Since the 2010 tax act reduced the.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Planning Guide Everything You Need To Know

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Does Florida Have An Inheritance Tax Alper Law

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How Is Tax Liability Calculated Common Tax Questions Answered

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Florida Attorney For Federal Estate Taxes Karp Law Firm

![]()

Does Florida Have An Inheritance Tax Alper Law

How Your Estate Is Taxed Or Not

Does Florida Have An Inheritance Tax Alper Law

Eight Things You Need To Know About The Death Tax Before You Die

Florida Gift Tax All You Need To Know Smartasset

Using A Florida Llc For Estate Planning Key Advantages Estate Planning Attorney Gibbs Law Fort Myers Fl